Monthly Market Summary

August 2018

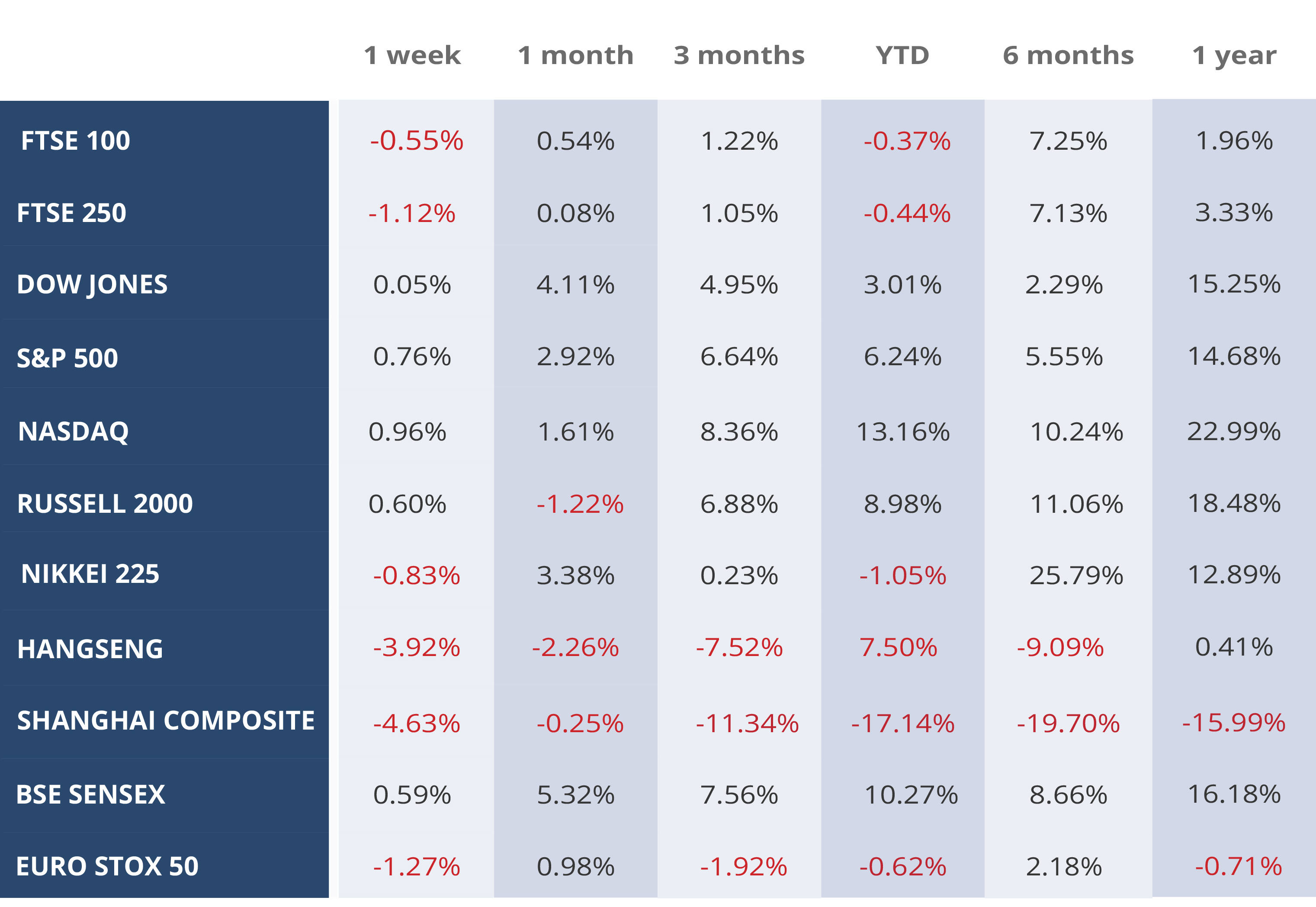

US

The strong earnings report and better than expected economic data prevailed over the trade war hysteria in the markets. A year on year increase of 6.6% in retail sales, a strengthening labour market with 213,000 new non-farm jobs created. Also, a stable Purchasing Managers Index (PMI), indicated rising consumer sentiment and business confidence in the US economy. The GDP rose by 4.1% in the second quarter, with inflation sitting at 2.9% which was above the Fed’s target and in the process making a case for rate hikes. The second quarter earning figures came out very strong with a majority of the companies beating estimates. Over the month the S&P gained 111.34 points (+4.12%), the Dow was up by +5.19% (1253.66 points), and the benchmark US Small Cap Index Russell 2000 was up by 29.07 points, a gain of 1.77%.

UK

BREXIT uncertainty remains the core concern of the UK markets. However, investors are hopeful that by the end of the year things will be much clearer about the type of BREXIT the UK is likely to have. The recent data suggested that the UK economy is going through a temporary slowdown. Nevertheless, the manufacturing and service sectors remain positive with a strong labour market and an unemployment rate below 4.2%. Sterling fell against the USD, aiding the FTSE 100 to end the month up 1.46% (111.83 points), the FTSE 250 gained 46.9 points (+ 0.23%).

Europe

The Eurozone composite PMI dropped marginally to 54.3 from 54.9 in June. German manufacturing PMI showed increased activity despite the risk of increased tariffs on automobiles. The ECB kept the rates unchanged and signalled to maintain them until the first half of 2019 at least. Trade tensions weakened in the latter part of the month after the EU President visited Washington and held talks with the US Trade representatives. Euro Stoxx 50 over the month gained 4.4% (149.93 points), and EURO ended the month at 1.17 (+0.2%) against USD.

Emerging Markets

The Chinese markets were the most affected as both US and China intensified their trade dispute, with new tariffs imposed and threats to add further tariffs. Signs are building that the economic expansion is losing steam—from weakening investment in factories to anaemic household consumption and rising corporate defaults. China’s central bank has been pumping funds into the country’s financial system. The Yuan fell -2.9% against USD over the course of the month.

India remained the second-best performer for the month of July 2018, with a return of 6%. Brazil was the best performer with returns of 9%.

Source: JP Morgan Asset Management, Wall Street Journal and CNBC News

WEEKLY EQUITY MARKET UPDATE – 05/08/2018