US ECONOMIC GROWTH HIT 3 PERCENT IN THE THIRD QUARTER 2017

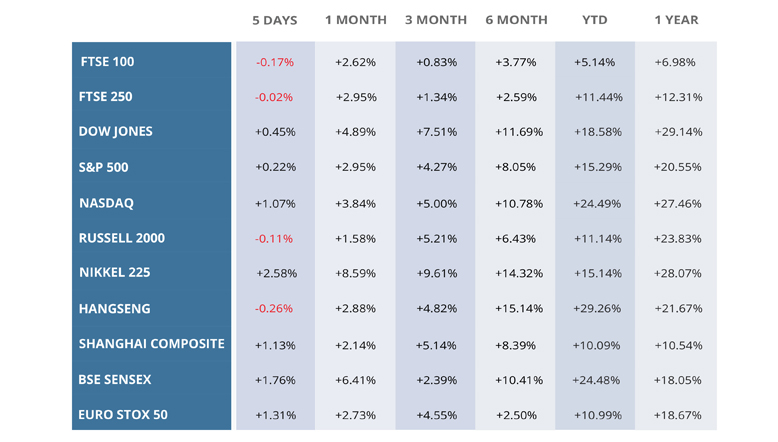

Latest Market Summary

US ECONOMIC GROWTH HIT 3 PERCENT IN THE THIRD QUARTER

Measured on an annualised basis, leaving little doubt that the Federal Reserve will raise rates at their December meeting. The last two quarters have been the strongest six-month period of economic growth in the US since 2014, whilst fourth quarter growth will likely be buoyed by the reconstruction effort following Hurricane’s Irma and Harvey.

THE ECB EXTENDS QE PROGRAM TO SEPTEMBER 2018

But reduces the value of bonds it buys to €30 billion a month from January 2018. The program could be extended further if Eurozone inflation stays below the 2 percent target, which it is expected to for several years. The central bank also announced that it would keep interest rates on hold, sending the euro to its worst week of the year.

SPAIN’S IBEX INDEX FELL 2 PERCENT ON FRIDAY

After the national government took charge of Catalan following separatists declaring regional independence. The move strips Catalan on its autonomy and government have implemented widespread removal of public sector officials. European equities have generally been stable since the independence referendum however this latest escalation could increase volatility.

PRIME MINISTER SHINZO ABE WINS JAPAN’S GENERAL ELECTION

Retaining a two-thirds “supermajority” in the lower house, with the result a clear endorsement of Abenomics and his governments yield curve control policy. Japanese stocks continued their rally on the news, closing a 16th consecutive week higher with the Nikkei 225 Stock Average reaching a fresh 21-year record close on Friday.

BRENT CRUDE CLOSES ABOVE $60

For the first time since July 2015, as the world’s top oil producers show support for an extension to the global output cut. Saudi Arabia and Russia will both likely vote to extend the current agreement, which runs out in March 2018, for an additional nine months. WTI and Brent crude finished the week at $53.90 and $60.44 a barrel, respectively.

IN OTHER FINANCIAL NEWS :

- Illinois issues $4.5bn in municipal bonds,,

the largest issuance since 2009, as the indebted US state attempts to reduce over $16.6bn in unpaid bills. - The South African rand suffers worst week since March,,

falling 4 percent against its peers, as economists expect another round of credit-downgrades. - Jeff Bezos dethrones Bill Gates as world’s richest person,,

after shares in Amazon surged 13 percent on Friday, sending the CEO’s net worth up $10.4bn. - Dubai will create a Dh2.7 billion e-commerce free zone,,

named Dubai CommerCity, which aims to tap into the $5bn Arabian Gulf e-commerce market. - Saudi Arabia announced plans for a $500bn megacity,,

called NEOM the city will cover 26,500 square km, span three countries and be 100 percent automated.

WEEKLY EQUITY MARKET UPDATE

Leave a Reply

Want to join the discussion?Feel free to contribute!