CHINESE SLOWDOWN UNSETTLES EMERGING MARKET INVESTORS

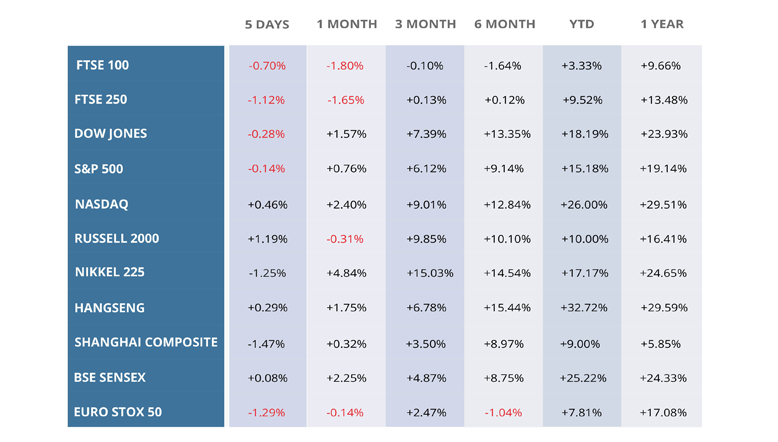

Latest Market Summary

CHINESE SLOWDOWN UNSETTLES EMERGING MARKET INVESTORS

The slowdown in China translated into fall in prices of various commodities, which lead to a major commodity driven sell-off across the Emerging markets. This in conjunction with the expectations of rate hikes in the US, the political crisis in Zimbabwe and the default by Venezuela on its Sovereign bonds further added volatility to the markets. The risk aversion displayed by the investors over this week was evident in the price rise of haven assets like Gold.

HIGH YIELD BOND FUNDS FACE MASSIVE OUTFLOWS

The High Yield bond aka junk-rated bond funds suffered a withdrawal of USD 5.1 bn last week to 15th Earlier this week the yield on junk bonds rose above 6% first time since March, for the month junk bond prices have fallen by more than 1%. However, prices rebounded on Thursday as institutional investors returned to the markets as yields and spreads increased.

LSE’S REPUTATION MARRED BY PUBLIC DISPUTE

The ongoing dispute between Donald Brydon, Chairman of the Board and Christopher Hohn, the manager of The Children’s Investment Fund (CIF) has ntensified after the latter has sought the removal of the former from the board. The management of the CIF, which holds a 5% stake in LSE was miffed with the arbitrary dismissal of LSE’s chief executive Xavier Rolet. The board is now contemplating on whether to release a public dossier on the behaviour of Xavier Rolet, to defend itself from the accusation of wrongly forcing him to resign.

FOOD PRICES RISE AT FASTEST RATE IN FOUR YEARS

Food prices rose at their fastest rate in four years during October as the fall in pound following the EU referendum continued to push the cost of living in Britain upwards. The price of food and non-alcoholic drinks was 4% higher in October than the year before. It was the highest rate of food price inflation since

Britain’s supermarket began a price war instigated by the arrival of discounters Aldl and Lldl.

SUPREME COURT BACKS HMRC OVER FILM TAX ROW

The Supreme Court has sided with HM Revenue & Customs over a film tax dispute, in a decision expected to protect more than GBP 1bn of revenue. The case concerned disputed tax losses arising from film partnership at the turn of the century.

CONCERNS THAT UK JOBS BOOM MAY BE SLOWING

The number of Britons in work has dropped for the first time in a year. Economists are divided whether the data were a blip or sign the labour market was beginning to turn. The level of employment fell briefly last year too, only to recover strongly in subsequent months.

IN OTHER FINANCIAL NEWS :

- Concerns that UK jobs boom may be slowing,

- The number of Britons in work has dropped for the first time in a year. Economists are divided whether the data were a blip or sign the labour market was beginning to turn. The level of employment fell briefly last year too, only to recover strongly in subsequent months.

WEEKLY EQUITY MARKET UPDATE

Leave a Reply

Want to join the discussion?Feel free to contribute!