This month we join millions around the globe to demonstrate our most profound solidarity with those impacted by breast cancer.

One of the reasons many people decide to live and work in the UAE is the zero per cent income tax. If that’s your case, the incentive might be an excellent opportunity for you to save more money. After all, you don’t have to pay out a large chunk of your salary each month in income tax.

Being able to save more money is great, because you want to ensure that money is there when you need it, not just for now but later in life. Whether it is for a comfortable retirement, your children’s education or a large asset purchase, you want to have money available.

Although this may be true, using a local or international bank to build up cash deposits won’t help your savings. The reason for this is simple. There is often zero or very little growth to this cash resulting in erosion due to real-time inflation. At the end of the day, your money is losing purchasing power while sitting in a bank savings account. Another key point to consider is the nature of a savings account. The money is always readily available to you. So you might end up using this cash to buy that extra pair of shoes, a night out or any other unnecessary purchase.

There’s a Better Way to Save

An anonymous source once said, “If you never save money or invest, you will always be poor, no matter how much you earn.” That’s a fact! We all know that if you always spend everything you earn you will never have money.

As mentioned before, saving money is great. You should keep it up but in a more structured way. A way that gives you the medium to long-term growth opportunity while maintaining an element of access in times of difficulty.

Did you know that if you save your money rather than investing it, you will probably have to put away a lot more for a lot longer to achieve the same result?

Let’s take a look at the case study of ‘John Saver’ and ‘Daniel investor’ as an example.

John Saver vs Daniel Investor: A Case Study

Both men are the same age, working for the same company and earning the same income. They both have no debt, and very little in terms of assets. However, they are at a point where they understand the importance of putting aside money for their future. They feel that they need to save $1 million by the age of 60 to be able to retire comfortably.

John Saver:

- Age: 40

- Annual Salary: $100,000 USD ($8,333 pm)

- Current Savings: $100,000 USD

- Savings Goal by 60 (Retirement): $1,000,000

- Required Monthly Contribution: $3,750

John is already 50% through his working life but has only managed to save one tenth of the amount he needs to retire. To get to the desired $1 million, he needs to put away $3,750 per month into his bank account for 20 years.

The problem is that John has always been a bit of a spender. It might be very ambitious and quite challenging to change that suddenly and put away almost 50% of his salary towards savings.

As a result, John often fails to either set aside the total amount or dips into his savings as unexpected costs arise.

Daniel Investor:

- Age :40

- Annual Salary : $100,000 USD ($8,333 pm)

- Current Investment: $100,000 USD

- Investment Goal by 60 (Retirement): $1,000,000

- Required Monthly Contribution: $2,000

Daniel is also in a similar position. He is already 50% through his working life and has only managed to save one tenth of the amount he needs to retire. However, Daniel decided to set up a savings account aimed at investing regularly. To achieve his retirement goal of $1 million, he will have to contribute $2,000 per month.

This money is directly debited from his account the day after his salary is deposited as a disciplined action. Therefore, he doesn’t even have a chance to notice the money gone.

Daniel’s funds are then actively invested and managed. They are now benefiting from the wonderful wonders of compounding interest. This means he is taking full advantage of accumulating interest on top of accumulated interest for all the years he is investing.

Let’s put compounding interest into perspective. Daniel’s initial deposit of $2,000 will be worth $5,300 at the end of the 20-year term! At the same token, his first year’s contribution of $24,000 will be worth $63,700 by the end of the term*.

As a result, Daniel can continue leading the life he enjoys. He can keep the small luxuries and current lifestyle, knowing he is well on the way to achieve his retirement goals.

In fact with the additional spending money that he is left with every year, Daniel is planning on taking a three week holiday travelling around Europe later this year and will be on track with putting a down payment on an investment property this time next year.

If Daniel decided to contribute the same amount to his investment plan as his friend John, he would have a whopping additional $787,000 in his pension pot by the time he was ready to retire.

So ask yourself… Do you want to work smarter, or harder? Are you John or Daniel?

* This projection is based on illustration purposes. If you decide to set up any structured savings, the term should be determined by affordability and time scales in the UAE. A short-term plan may suit you better.

You no doubt have heard about The benefits of diversification, It’s not just “all talk”. Your portfolio must have some degree of diversification. After all, you don’t want to “put all your eggs in one basket”.

You no doubt have heard about The benefits of diversification, It’s not just “all talk”. Your portfolio must have some degree of diversification. After all, you don’t want to “put all your eggs in one basket”.

Investing all your money in one or a limited number of assets increases the risk of your portfolio. If something goes wrong with one of these assets, this could impact all your money. Rather than having all your eggs in one basket, you take some and put them in different baskets (asset classes). That’s diversification.

What is Diversification?

Diversification is the attempt to reduce exposure to risk by spreading your investment across carefully selected asset classes and geographical regions. You can achieve diversification by allocating, for instance, a certain percentage of your investment to fixed income, equities, real estate, alternative investments, in different sectors, industries or countries.

Although diversification is no guarantee against loss, it’s a prudent strategy you can adopt towards your long-term financial goals.

Why Diversification Work?

Many studies demonstrate the effectiveness of diversification. To put it simply, when you spread your investment across low correlation assets, you reduce the exposure to volatility. The reason for this is that different asset classes and geographical regions don’t move up and down simultaneously or at the same rate. So, if you mix things up in your portfolio, you’re less likely to experience major drops. Remember that some sectors might be thriving while others are going through tough times.

How to Diversify Your Portfolio?

Personal finance courses teach this concept widely in contrast to individual stocks investing. They consider single stock investing similar to casino gambling. In fact, many investors never even invest in individual stocks. Instead, they prefer mutual funds and exchange-traded funds (ETFs). These funds bundle hundreds of stock from various companies and sell them as a singular unit.

You can diversify your portfolio by selecting mutual funds and ETFs from different sectors that follow different trends. Some might follow the ups and downs of the broader market while others remain relatively flat. Other funds might move inversely to the broader market, experiencing ups when most sectors are down and vice versa. So no matter how the market is behaving, a portion of your portfolio is likely to do well. At the same time, this strategy protects against the full exposure of a correction.

Generally speaking, a well-balanced portfolio diversifies away the maximum amount of market risk. Owning additional asset classes takes away the potential of big gainers significantly impacting your bottom line. This is the case with large mutual funds investing in hundreds of stocks, in theory, putting your eggs in hundreds of different baskets.

Following on from us covering the difference between Saving vs Investing and with so much reported on the recent market movements, it would be important to highlight why and what the impact is of investing at the right time. Also what the true effect is of continuing to use purchasing power over time to ultimately add value to your portfolio.

While much information circulates in our community regarding the impetus to buy good value stock, equity or units in funds, there is one classical item which could use attention with respect to the value of buying during corrective periods. That item is the power of Dollar Cost Averaging over time.

When you create and review a set of dollar cost averaging numbers, it becomes apparent that during these periods of severe price decline or correction, accompanied mental exhaustion, great wealth is made.

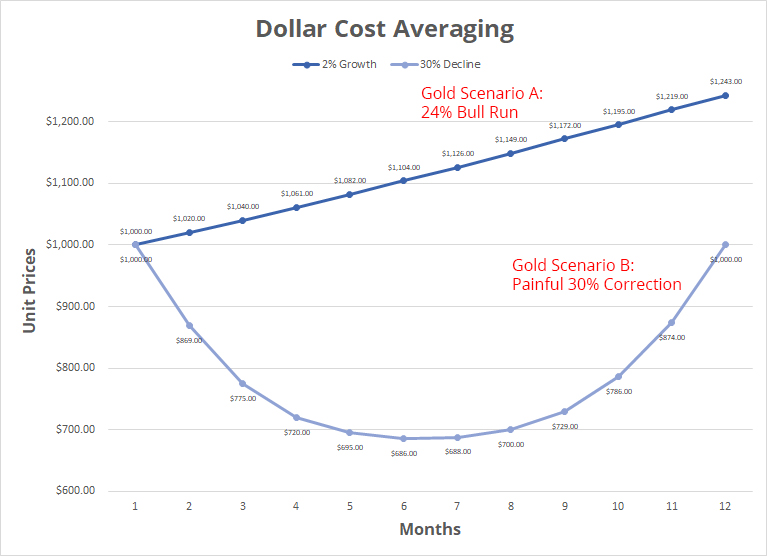

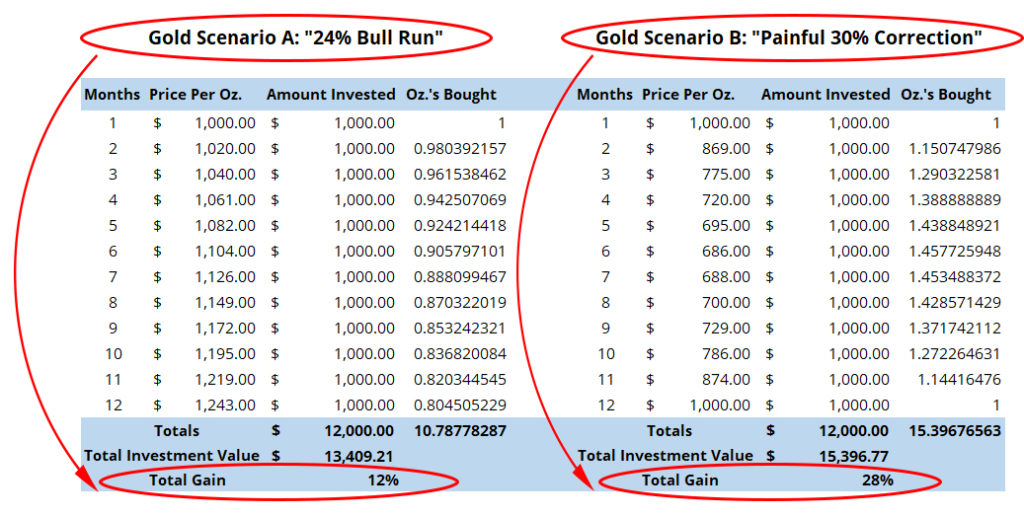

Illustrated below are two hypothetical price performance periods using gold as an example:

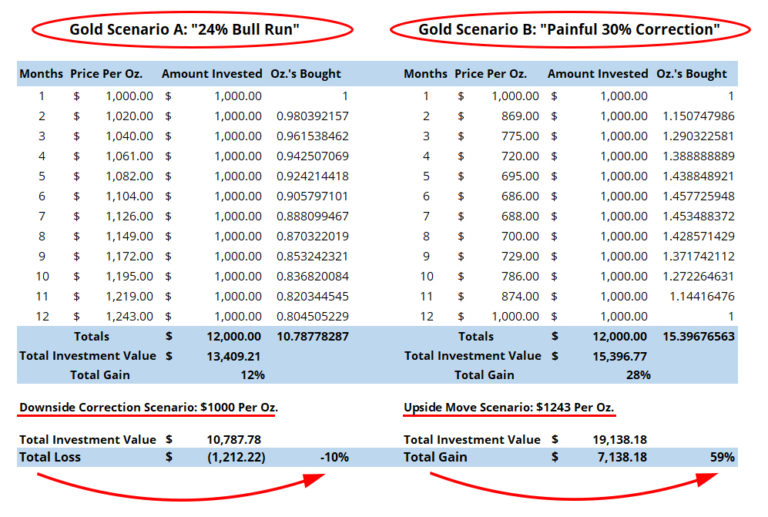

Gold Scenario A: depicts a 12-month period of increasing gold prices compounded at a 2% rate, producing a total of a 24% “bull run”. Gold Scenario B: depicts an extremely painful 30%+ correction and subsequent recovery to starting-point levels over a 12-month period.

At first glance, you might assume an investor gained 24% under Scenario A and nothing under Scenario B except for potential losses and grey hair. A closer look at a set of dollar cost averaging data however, tells a wildly different story.

Let’s assume an investor has the courage to create and execute a $1,000 a month investment program towards buying units. In applying that program to the two scenarios laid out above, a fascinating result begins to emerge:

As the numbers demonstrate, Scenario A’s 24% “bull run” produced a pitiful return on capital, and as a headline figure was very misleading. A disciplined investor allocating $1,000 a month under this scenario, saw a total real gain of only 12% at the end of the twelve month period.

Under Scenario B however, our disciplined investor’s $1,000 a month investment program produced a total real gain of 28% on his or her capital, in what could be described as a “sideways” (or unprofitable) unit price environment.

What’s also interesting to note, is that not only did Scenario B produce a far greater gain, but it does so at a (counter-intuitively) much lower risk.

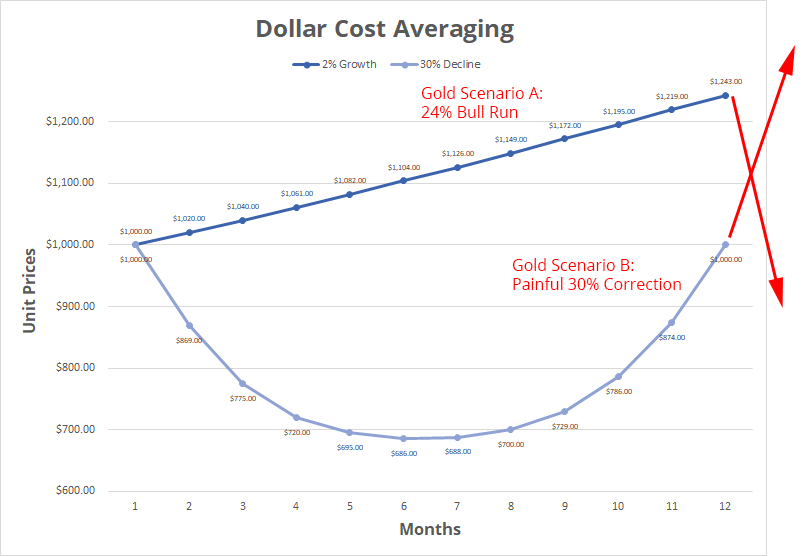

To illustrate, let’s assume that at the end of the 12-month period Scenario A suffers a “minor dip” in price, returning to its initial starting level at $1,000 per unit. Let’s also assume Scenario B jumps by 24%, effectively switching places price-wise with Scenario A. Here is a chart of that price swap:

As mentioned, while this price swap appears to be just a “minor dip and corresponding jump”, as the numbers will indicate, the risk of financial loss in Scenario A becomes staggering, while the upside gains under Scenario B become equally explosive:

As demonstrated, a correction to starting point in Scenario A produces a real total loss of 10%. A price swap in Scenario B on the other hand (i.e. a move from $1,000 per unit to $1,243 per unit), produces a 59% total gain. Therefore, the disciplined investor who continued to allocate $1,000 a month in the face of a frightening 30% collapse, was rewarded tremendously.

The moral of the story here is to continue to add fresh capital to your investments during declines. And it doesn’t have to be in just one Fund you can utilise those Funds surrounding Commodities, Healthcare, Technology or Shares of Companies.

Additionally, when struggling through the corrective depths of any asset’s “Scenario B”, it’s important to ensure that whatever you’re accumulating has real (and strengthening) fundamental value. Therefore, the longer the corrective period persists the greater will be your ultimate upside in the subsequent recovery. In other words, with strengthening fundamentals time is labouring for you rather than against you.

Bottom Line: The discipline of incremental investment over time may position one for explosive upside gains and reduced downside risk. Ensure that whatever is being accumulated however, is fairly priced, and of increasing fundamental value.

This content is an extract from the Friends Provident International’s Education Funding brochure. If you are an expat living in the UAE and planning for your child’s education, you may find this information useful. We will be sharing the views of our providers regarding this and other relevant topics throughout our “Back to School” campaign. If you have any questions, please contact us at 00971 4 436 1811 or email us at info@aopartnership.

This content is an extract from the Friends Provident International’s Education Funding brochure. If you are an expat living in the UAE and planning for your child’s education, you may find this information useful. We will be sharing the views of our providers regarding this and other relevant topics throughout our “Back to School” campaign. If you have any questions, please contact us at 00971 4 436 1811 or email us at info@aopartnership.

With entry to the top educational institutions becoming more and more competitive and the costs continually rising, it’s important that you plan ahead so that your children get the best possible start in life.

Your children may want to return to the UK for their university education, in line with a great many British expatriates. This is not surprising. Apart from family and cultural links with home, UK universities enjoy a strong global reputation. In terms of popularity with international students, the UK is second only to the considerably larger US. An impressive 76 UK universities feature in the QS World University Rankings® 2018, with four currently ranked among the world’s top 10 and 16 UK universities appearing in the top 100 (source: QS world university rankings 2018).

The total cost of attending university can be over GBP 100,000, even in the UK.

You will want to consider all the implications and costs up front, as university education can be expensive in any of the leading countries such as the UK, the US and Australia. While there are the more obvious tuition and course fees, room and board, living and travel overheads to consider, there are other important factors to take into account, such as some courses requiring specific equipment. If your children want to live on campus, or if living in halls of residence is mandatory in the first year, accommodation costs can be high.

There is another important factor for you to consider if your children intend to study at university in the UK. Even if you and they have British passports, they are likely to be regarded as international students if you are still living abroad as an expatriate family. To be treated as a domestic rather than international student, they must have been ordinarily resident in the UK for the full three-year period before the first day of the first academic year of their course.

This has three significant financial implications

1. As international students, they will pay up to three times more in annual fees than domestic students.

2. It is unlikely that they would qualify for access to government-sponsored financial student support such as tuition-fee loans.

3. As British passport holders, it is unlikely that they would be eligible for many of the scholarships and grants that are available to international students studying in the UK.

So, the costs of supporting your children will be significantly higher and your options for paying for these costs will be reduced. These issues will be magnified if you end up having two or more children at university at the same time.

If your children were able to qualify as domestic UK/EU students, then their tuition fees for an undergraduate degree would be up to GBP 9,250 per year (2018) for universities in England and up to GBP 9,000 per year for universities in Wales, and they may be able to apply for government financial support. Once you include the living and travelling costs associated with a student from an expatriate family, even putting your child through university in the UK as a domestic student is costly.

If your children were able to qualify as normally living in Scotland and they attend a Scottish university, they would ordinarily be eligible to have the tuition fees for their first degree paid in full by the Scottish Government. If they qualify as normally living in Northern Ireland and they attend a university in Northern Ireland, their tuition fees would be GBP 3,925 per year (2018). These tuition fee arrangements also apply to students normally living in an EU country, but not in the rest of the UK.

Students from Wales are fortunate as they are entitled to support, in the form of a grant, from the Welsh government. For further information, please refer to www.studentfinancewales.co.uk.

You may also want to consider that your children may choose to study at a university outside of Britain.

There is also a growing trend for children from expatriate families to choose a course at a university outside the UK, particularly in countries that could be considered to enjoy strong reputations for the quality of their education and lifestyle, such as the US, Australia or Canada. Tuition fees and living costs at top US universities are currently around USD 60,000 (GBP 44,400) per year*, with very few institutions offering financial aid or scholarships to international students. Tuition fees for international students studying at an Australian university are on a par with the fees charged in the US.

Wherever they choose to study, providing the quality education your children deserve could be more affordable than you think, as long as you plan your savings in advance.

This article was written by Philip Cernik, Chief Marketing Officer of Friends Provident International. On this article, Philip explains the three types of life insurance available to you. He makes a comparison between term insurance and whole of life and explains why Friends Provident doesn’t offer the later.

This article was written by Philip Cernik, Chief Marketing Officer of Friends Provident International. On this article, Philip explains the three types of life insurance available to you. He makes a comparison between term insurance and whole of life and explains why Friends Provident doesn’t offer the later.

You may already have a life insurance policy. You may be thinking of buying a life insurance policy. You may be thinking you need more life insurance. Whichever of these applies to your circumstances today, pause for a moment to consider the various alternatives at your disposal, and what might be your best course of action.

There are hundreds of insurance companies worldwide, and thousands of products on offer, but here in the UAE there are a limited number of authorised providers. A quick check of the UAE Insurance Authority website (www.ia.gov.ae) will tell you exactly which companies are regulated here, offering you all the statutory consumer protection you would expect.

It may seem an impossible task narrowing down the choice to the right life insurance product for you, but don’t worry: all the products generally fall into one of three categories – term insurance, endowment or whole of life – and an adviser should be able to steer you through the purchasing process. Let’s take a moment to look at the three types.

1. Term insurance – this is the most cost-effective way to insure your life against death and/or a critical illness. You select a term (typically between one and perhaps as many as 50 years) and the level of cover you require. At the end of the term there is no return: think of it like car insurance – if you have an accident, you are covered but if you don’t, you won’t get any money back.

2. Endowment –again you select a term but this is essentially a savings product so instead of selecting a level of cover, you select how much you wish to save on a regular basis. An endowment typically has a minimal level of cover payable if you die (usually to qualify for favourable tax treatment) and the vast majority of your premiums are invested for you, to generate a return. You can usually either choose your own investments (unit-linked funds) or leave it to the insurance company (with-profits).

3. Whole of life – this is a hybrid product that combines life and/or critical illness cover and savings. Depending on the life company, your payments can be directed mainly to life cover or savings. The difference between whole of life and the other two products is that you don’t have to select a term. It continues until you stop paying premiums, die or suffer one or more of a defined range of critical illnesses.

So far so good. Let’s look at your options when it comes to arranging cover on your life.

Let’s imagine you are a non-resident Indian or a UK expat. You want your spouse to inherit a sum of USD 1 million if you die, and you want a sum of USD1 million for yourself if you are diagnosed with a critical illness:

Your (three) options:

1. Term insurance is the low cost option. For a male non-smoker aged 40 who wishes to take life insurance and critical illness insurance for a period of 25 years, the cost would be USD541.83* per month with Friends Provident International. In summary, USD162,549 paid over the term of the policy, for USD1 million cover, with no return on investment.

2. Whole of life would cost more but there could be a surrender value to offset this. A typical premium from one of our competitors (we do not offer whole of life for protection – more on this later) reveals it would cost the same male aged 40 USD1,198* per month and there would be a surrender value of USD341,898 in 25 years based on a growth rate of 6% pa. after charges. In summary, USD359,400 paid over the period for the same USD1 million cover, for a return that is USD17,502 less than the total premium paid.

Now let’s go back momentarily to why we don’t offer whole of life for protection. We believe that whole of life policies currently available in the UAE market do not represent great value for customers. When we launch a whole of life policy we want to tackle the issue of having to pay for cover at times when you don’t need it, for example before you have any dependents or liabilities (such as children or a mortgage). We find many people buy cover (quite rightly) before they need it, because it is extremely difficult to secure cover once you begin to suffer health complications.

3. There is another way today, however: buy term insurance and invest the rest. In the same example above, a combination of a term insurance and a savings plan for 25 years (for the same cost as a whole of life with a competitor) would cover you for the same USD1 million of benefits but would generate a value after 25 years of not USD341,898 (competitor’s whole of life projection) but USD430,618, based on a growth rate of 6% pa. after charges. It wouldn’t cover you for life but after retirement most people don’t have an income to insure, have repaid mortgages and loans and don’t have dependent children – basically you probably won’t need cover for the whole of your life. The exception to this might be when you are seeking cover to pay an inheritance tax liability, but that requires setting up a policy in a totally different way.

In summary, USD359,400 paid for a 25 year Friends Provident International term insurance and a separate savings plan, assuming 6% pa growth after charges would return USD430,618.

Or, to put that another way, USD88,720 more after 25 years than a competitor’s whole of life policy for the same cover and premium.

You should speak with your financial adviser to find out which life and critical insurance option is best for you.

* Assumes standard rates apply

HM Revenue & Customs Sign outside the main London office on Whitehall, Westminster, London, UK.

If you are a UK taxpayer, you have up to 30 September to declare any foreign income or profits on offshore assets. This also includes nondisclosure of tax due on UK assets by non-UK residents of any nationality. The information is provided by HM Revenue & Customs (HMRC) and Charted Insurance Institute (CII).

The new legislation is called ‘Requirement to Correct’. It requires UK taxpayers to notify HMRC about any foreign tax liabilities relating to UK tax, capital gains tax or inheritance tax.

Many people don’t realise they have to declare their foreign financial interests. If you are not sure, here are some examples. Under the rules, if you are renting out a property abroad, transferring income and assets from one to another country, or even renting out a UK property when living abroad, you could face a tax bill in the UK.

There’s no way to scape

The UK Government is putting on their efforts in tackling offshore tax evaders.

According to Mel Stride, Financial Secretary to the Treasury “since 2010 we have secured over £2.8bn for our vital public services by tackling offshore tax evaders, and we will continue to relentlessly crack down on those not playing by the rules”.

“This new measure will place higher penalties on those who do not contact HMRC and ensure their offshore tax liabilities are correct. I urge anyone affected to get in touch with HMRC now”.

Also, from 1 October more than 100 countries, including the UK, will be able to exchange data on financial accounts under the Common Reporting Standard (CRS). CRS data will significantly enhance HMRC’s ability to detect offshore non-compliance and it is in taxpayers’ interests to correct any non-compliance before that data is received.

The most common reasons for declaring offshore tax are in relation to foreign property, investment income and moving money into the UK from abroad. Over 17,000 people have already contacted HMRC to notify the department about tax due from sources of foreign income, such as their holiday homes and overseas properties.

We have also seen an increasing number of clients, owners of property in the UK, been contacted by HMRC. It’s fairly easy for the HMRC to compare land registry records for registered owners against Council Tax records for any difference in names.

Correct your tax liabilities by:

- Accessing HMRC’s digital disclosure service as part of the Worldwide Disclosure Facility or any other service provided by HMRC as a means of correcting tax non-compliance.

- Telling an officer of HMRC in the course of an enquiry.

- Any other method agreed with HMRC.

Once you have notified HMRC by 30 September of your intention to make a declaration, you will then have 90 days to make the full disclosure and pay any tax owed.

If you are confident that your tax affairs are in order, then you don’t need to worry. But, if you are unsure, one of the Alpha tax professionals can assist you. You can contact us here.

We would like to share with you this excellent article on the power of the compound interest, published by Canterbury Property Services back in 2017.

We would like to share with you this excellent article on the power of the compound interest, published by Canterbury Property Services back in 2017.

One of the most important subject when it comes to saving – Compound Interest. No matter what your age, now is the time to begin saving for retirement.

The rich are not rich because they earn a lot of money; the rich are rich because they saved a lot of money. Those who become wealthy do so by spending less than they earn. There is no other source of saving and by extension, of building wealth.

If saving is the key to wealth, then time is the hand that turns the key to unlock the door. There is no reliable method to quick riches. There are however, proven methods to get rich slowly. If you are patient, and if you are disciplined, you can produce a golden nest egg that will hatch later in life. It might appear that the pittance you save now could not possibly make a difference, but that is because you haven’t considered the extraordinary power of compound interest.

The power of compound interest

The best way to ensure your future financial success is to start saving today, even if all you have seems like a paltry sum. The amount of capital you start with is not nearly as important as getting started early. “Procrastination is the natural assassin of opportunity. Every year you put off investing makes your ultimate retirement goals more difficult to achieve.”

The miracle of compound interest is the secret to getting rich slowly. Even modest returns can generate real wealth given enough time and dedication, but mainly time.

On its surface, compounding is innocuous, even boring. “So what if my money earns less than 3 percent in a high-yield savings account?” you may ask. “What does it matter if it averages 8 percent annual growth in a mutual fund? Why is it important to start investing now?”

In the short-term, it doesn’t make a huge difference — but don’t let that fool you. On the slow sure path to wealth, we need to keep focused on long-term goals. Short-term results are not as important as what will happen over the course of 20 or 30 years.

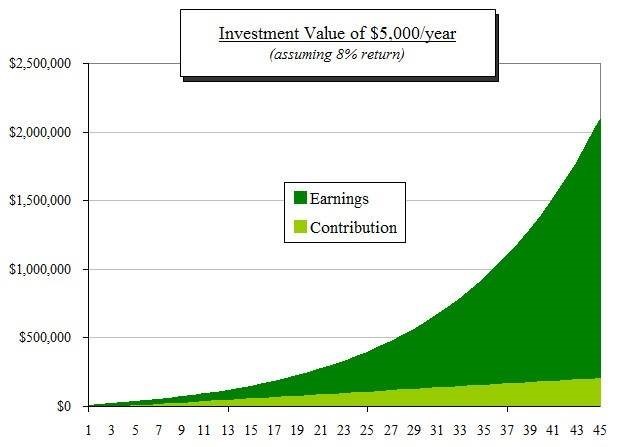

The growth of annual $5,000 contribution

Compounding can be made even more powerful through regular investments. It is even more exciting to see what can happen when you make saving a habit. If you were to contribute $5,000 annually to a structured plan for 45 years, and if you left the money to earn an average 8 percent return, the retirement savings would grow to more than $2 million, as you can see from this chart:

A golden nest egg indeed! You would have more than eight times the amount you contributed. The dark green part of the chart dwarfs the light green, which is the money you have put in.

This is the extraordinary power of compound interest!

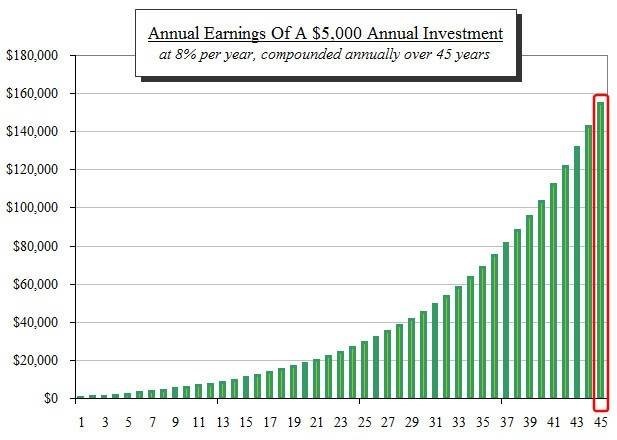

The cost of waiting one year

It’s human nature to procrastinate. “I can start saving next year,” you tell yourself. “I don’t have time to start — I’ll do it later.” But the costs of delaying your investment are enormous and even one year makes a huge difference.

The difference is so dramatic when you look at what you lose by waiting a year even though you regularly contribute to your savings. If you make annual contributions of $5,000 to your structured plan as shown in the example, waiting just one year will cost you more than $150,000! That is probably more than your annual income.

There is another way to look at the cost of delaying. If you still wanted to have a $2 million nest egg at age 65, but you wait five years to get started, the annual contributions would have to increase to nearly $9,500 — that’s almost double. If you were to wait until age 40, you’d have to contribute nearly $55,000 a year.

How to get rich slowly

You can make compounding work for you by doing a few simple things:

1. Start early. The younger you start, the more time compounding has to work in your favour and the wealthier you can become. The next best thing to starting early is starting now.

2. Make regular investments. Don’t be haphazard. Remain disciplined, and make saving for retirement a priority. Do whatever it takes to maximize your contributions.

3. Be patient. Do not touch the money. Compounding only works if you allow your investment to grow. The results will seem slow at first but continue on. Persevere! Most of the magic of compounding returns comes at the very end. Compounding creates a snowball of money. At first, your returns seem small; but if you are patient, they will become enormous.

Your will is the best decision you can make to protect your loved ones. To ensure you look after your family especially after you have gone. The reality is that so many people neglect their affairs after their passing, only to add to the distress of those they leave behind.

Your will is the best decision you can make to protect your loved ones. To ensure you look after your family especially after you have gone. The reality is that so many people neglect their affairs after their passing, only to add to the distress of those they leave behind.

It’s Never Too Early to Have a Will

While most would agree that writing their will is crucially important, it is so often left too late. Let’s face it – it is not something we like to think about. But there are so many reasons to think about it now:

- Easing the lengthy process of dealing with your affairs for your loved ones, business interests and employees if applicable.

- Naming your beneficiaries and avoiding uncertainty and disputes.

- Providing clear directions on how you would like to deal with your affairs.

- Protecting your children by appointing guardians until they reach age 18.

And If You Don’t Have a Will?

- Your closest loved ones may not only have to suffer the distress of your passing, but also the financial distress of wading through your financial affairs. There may be no clear path on what different family members receive, resulting in unnecessary conflict.

- Those you leave behind will need to employ professionals to sort out your affairs. This could be a lengthy, distressing and expensive process.

- If you have young children and have not stipulated who will look after them once you are gone, the court will need to appoint someone that may not have been your choice.

Drafting The Right Will For You

There are many options available. From standard, corporate or mirror/- joint, through to flexible, discretionary or property trusts, our specialist legal partners will help you decide which type of legal will you need within your own personal circumstances.

What are some of the things you need to consider? Are you liable for inheritance tax? What liabilities do you have? What savings plan, pensions or life insurances do you have in place? Do you have a business to consider? Which of your assets is within the UAE, or in your domicile country?

As an expat, there are other formalities you need to consider to make your will legal in the UAE, such as translation and attestation/notarisation. Our specialist legal partners will guide you through the process to make sure your will is as watertight as possible.

While within our scope of services we do not offer will writing services directly, we do provide access to the most credentialed, qualified and recognised UK lawyers. We would be happy to arrange the best will advice under your personal circumstances.

We would like to introduce you to our client Jennifer Gonzalez-Diaz, Sales Manager, Digital Content at DU Telecommunication. In this interview, Jennifer shares her experiences about her critical illness journey, the impact on her life and the importance of protection.

We would like to introduce you to our client Jennifer Gonzalez-Diaz, Sales Manager, Digital Content at DU Telecommunication. In this interview, Jennifer shares her experiences about her critical illness journey, the impact on her life and the importance of protection.

Q – So Jen, what protection have you taken out?

JGD – we’ve taken the Life Insurance protection which includes Critical Illness as part of that Life Insurance

Q – Why did you take out the protection?

JGD – It was a decision I made with my husband because we’d just had a baby and thought that having protection wasn’t only something that was good for us in case of any issues but for our baby boy. This was in case of anything happening to both of us that the family would have some sort of protection that they wouldn’t feel the financial burden. So, it was really to think about planning for the future, without one of us or even without the both of us that the family would not feel the burden.

Q – You met with James McMullan one of the Financial Planners at Alpha. How did you feel about James in addressing your requirement?

JGD – James was great in addressing our requirement. In fact, it was more of an eye opener for us during the first discussion with James. This was because Life Insurance was something that I was getting from my employer, as part of a cover that my work offers.

It wasn’t necessarily something that I thought would be needed as an extra or an add-on for my husband, but James listened to whatever we had. He also listened to our financials, future plans and our family plans. He looked at more than just the numbers, he just heard us and listened to everything that we had to say regarding our family plans and as a conclusion, he gave us several options. Each and every one of these options was tied to our plans it wasn’t just something that was generic, it was very specific to our needs.

The Life Insurance in particular was very much of interest because we had just had a son and as a priority, thinking about the future of our family and potentially anything happening to us, it would really make sense to have Life Insurance in place, especially because it included Critical Illness.

Although we always think that we are going to live a long and happy life, which we always wish for and hope for, we don’t actually foresee anything negative happening and this type of planning has really helped us to prevent any major obstacle financially in case of any bad luck arising.

Q – You took the insurance out in May 2017, has anything happened since you put the cover in place?

JGD – Yes, so in May 2017 we took the insurance which was a couple of months after having our baby boy and just over three months later believe it or not I was diagnosed with Breast Cancer.

I remember it was on the 8th of September 2017 that I went for a breast ultrasound, which I then had to have a breast mammogram and then a biopsy. A few days later came a conclusion that it was Breast Cancer.

I have always been healthy, a very healthy lifestyle, never smoked hardly drank and as opposed to some of my friends who do smoke and drink. It was however me that was told at the age of 34 with a baby only a few months old you I am now having to face the biggest challenge of my life, so yeah that’s the big thing that happened.

Q – When this all happened did you receive any support from James and AOP, or was it a case of you getting on with it on your own?

JGD – No, Not at all. It wasn’t a case of us having to deal with things on our own, James spoke with my husband after finding out that I had been diagnosed with Breast Cancer.

James said to us don’t forget your Life Insurance has Critical Illness included. In those moments you don’t actually think and forget everything that you have. You don’t remember the specifics of whatever contracts you have negotiated purely because you’ve got bigger things to worry about.

James was there all along to ensure that we were supported; and he took everything into his hands. To check whether my case could be filed under the Critical Illness cover and managed to speak with all the relevant people. We got support from the beginning to the end. From filing the request to check whether or not the case would be accepted by Zurich to looking for all the information from the medical experts. Everything was taken care of by James.

Q – I take it then from that answer you did get paid the Critical Illness cover?

JGD – So we got the cover allocation from our insurance given to us, paid into our account very quickly. It was a matter of days really after the claim was successfully accepted. It was literally a matter of days for us to see the amount deposited into our account.

Q – Having that money paid out, did it give you a sense of ease, put your mind at rest that you didn’t have to worry about expenses?

JGD – Absolutely, for all of those who live in the UAE, we all face the same challenge which is that we all have medical insurance because it is compulsory, which is great. But potentially those insurances may have a cap on treatment. My medical insurance did have a limit amount on it and it’s something that we should keep in our mind that there could be a cap included.

Critical Illness cover especially is great because it gives you peace of mind. If you need access to additional treatment outside of whichever country you find yourself in, the treatment can be made available to you, which may not be if you do not have additional cover or money available in your pocket.

Also if you don’t need that money straight away it helps to essentially not think about financial concerns, if anything was to be escalated and you had to look for further options you know that you’ve got that amount of cash in the bank for that purpose.

Q – A pretty obvious answer coming up I think, but in hindsight are you glad you took the insurance when you did?

JGD – Yes, absolutely I am and I definitely recommend anybody taking the same sort of approach. It does seem like a significant commitment and it is something that you can’t take lightly. But, we will at some point, we are not immortal so we will face death sooner or later, hopefully it’s later and if it happens sooner or whenever, you need to have the peace of mind that you’ve got a structure and financial support to back you up and back your family up. So, yeah definitely glad to have taken that.

Q – Important to point out at this stage that you look really, really good. You look strong, you look healthy. Ok, your hair is a little shorter than we are used to seeing you with but it hasn’t been like that all the way through. How did your life change from September 2017 until now, what’s happened over the last 10 months?

JGD – A lot has happened, I went through a number of treatments. Sessions of Chemotherapy first, followed by undergoing breast surgery with immediate reconstruction and followed by 25 sessions of radiotherapy which was then followed by a series of continuous, what we call targeted therapy treatment which is what I am still going through now. So, essentially a series of treatment every two or three weeks or potentially every single day of the week.

Physically weight gain with steroids feeling extremely weak being prone to lots of different virus’s and diseases due to weaker immune system.

However little by little losing hair from not only my head but eyebrows and eyelashes which makes you feel less of a person, sometimes you can’t even recognise yourself. So a lot has happened but a lot has changed since, I am stronger now and feel stronger now and I am now what they call no evidence of disease, so there is no evidence of disease at it stands today and I am still in active treatment.

By the way, the money from the insurance has helped me because I did reach my medical insurance cap, but I feel strong, I have energy back and back to an exercise routine, so you could say a lot has happened in what is less than a year.

Q – It sounds like at the moment it’s all good news, things are moving in the right direction, how does that make you feel?

JGD – it makes me feel great, it was definitely a great start to the whole rollercoaster to have that financial cover sorted straight away for me from the beginning and it was really a peace of mind. The last thing you want to think about when you are being told that you’ve got such an illness is to worry about the financial side of it and when you don’t have to worry about it, it’s a huge weight lifted off your shoulders.

Q – Is it fair to say that because of the personal approach and support you would recommend James to any of your colleagues and friends ?

JGD – Yes, without a doubt. I have already introduced James to some of my friends to help with their own cover needs and will not hesitate to recommend him again.

Q – so finally then, if you were trying to raise awareness and had a message for anyone else, whether it be a husband and wife, a family or somebody on their own that were not sure if they should be taking cover out for themselves, what would that message be ?

JGD – Don’t think about it twice just go for it whether you do have a direct family i.e. wife, husband, kids or not. Your life might change at any point in time. You should make sure that money is the last thing you worry about, if your life does change because of a Critical Illness.

Yes, you might be in the best shape you’ve ever been, or you’re not quite sure and you’ve had some issues, don’t over think it just go for it. It’s something that will come out of your bank account on a monthly basis easily; it’s a way of investing in yourself, in your own future without having to think about keeping the cash in a bank account. Put it into a structure that will help at any point in time to give it back to you when you need it, so just go for it.