April 2018

Monthly Market Summary

April 2018

The volatility in March was mostly driven by the concerns of a Trade War between the two biggest economies in the world, namely the US and China. The month started with the hawkish tweets from Donald Trump signalling possible tariffs on imports, although the rhetoric toned down with the Europe managing to get an exemption from tariffs. The markets feared that any retaliatory measure from the Chinese side will dampen the trade and the hard-won growth momentum in the economy. The threat of the trade war became real when the Trump administration announced the tariffs on steel imports from China.

The market sentiment was further dampened by Fed’s interest rate hike, which was the first of its four-planned rate hikes this year and the sixth since it began raising interest rates in December 2015. The Technology sector took a major dip due to the risk of increased regulations after Facebook was found to have been involved in a user-data controversy linked to Donald Trump’s presidential campaign in 2016.

Summing it all up, markets in the month of March followed the high volatility trend it inherited from February 2018, depicting the phenomenon of “Volatility Clustering” which essentially means a period of high volatility is followed by another period of high volatility till a reversal or an inflection point is reached.

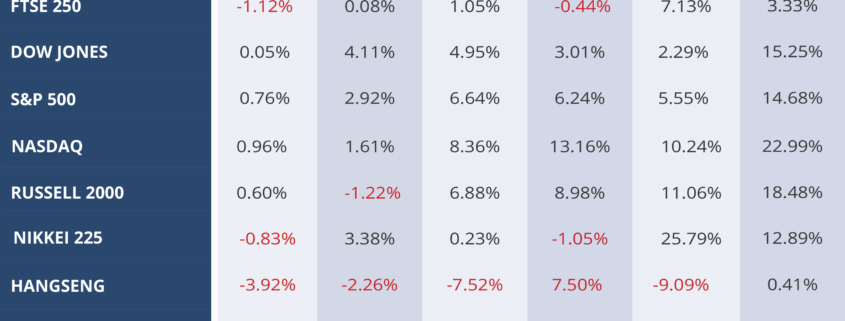

The major US markets ended the month in red with the Dow Jones Industrial Average losing 3.68 per cent, while the Standard & Poor’s 500 Index sliding 2.74 per cent and the NASDAQ Composite falling 2.90.

In addition to the global trade concerns, the BREXIT woes continue to haunt the UK markets. The FTSE 100 & FTSE 250 ended the month in negative 2.42% and negative 1.15% respectively.

Despite stronger earnings data in Europe, the markets succumbed to the pressure of increased tariffs and the resulting trade war. The STOXX 50 lost nearly 2% over the month.

The Nikkei 225 lost 2.04% this month, the Japanese bourse came under pressure from a stronger yen and global trade fears. It is also a major concern among investors that Japan can be the next target of US trade tariffs. The major emerging markets moved in concert with the developed markets, with the HangSeng losing 1.26%, the Shanghai Composite down by 2.05% and BSE Sensex fell by 3.43% in March.

Despite the increase in rates by the Fed, the Treasury yields fell in March due to the revised labour report, weaker than expected inflation data and the increased buying activity in the bond markets prompted by the volatility in equity markets as the investors looked for safer assets in the market. The 10-yr Treasury Yield ended the month at 2.741%, down 0.131 percentage points.

WEEKLY EQUITY MARKET UPDATE – 01/04/2018

Leave a Reply

Want to join the discussion?Feel free to contribute!