The history of volatility

During the first half of the year, we have seen varied levels of volatility around the world. This was triggered by several events such as political decisions (mainly in the US), fluctuating oil production, trade dispute, conflicts, uncertainty and the end of Quantative Easing.

As an investor, you should know that investing is a marathon, not a sprint. Investing with a long-term outlook and long-term goals is the best way you can reduce the impact of stock market fluctuations. However, you no doubt may ponder over the risks and rewards of investing. Ponder over how to manage your portfolio to minimise the effects of adverse markets movements.

The first thing to understand is that risk is a necessary and constant feature of investing. Stocks fall, economic conditions fluctuate and companies can go bankrupt. In fact, the very returns that assets generate may reward you for the risk you take.

Secondly, there are many different asset classes available you can invest in, each possessing different risk traits.

With that in mind, one of the best ways to weather volatility is making sure to diversify your portfolio. Diversification may help to boost returns over the long-term and provide some protection against losses, giving you greater peace of mind in periods of market turbulence.

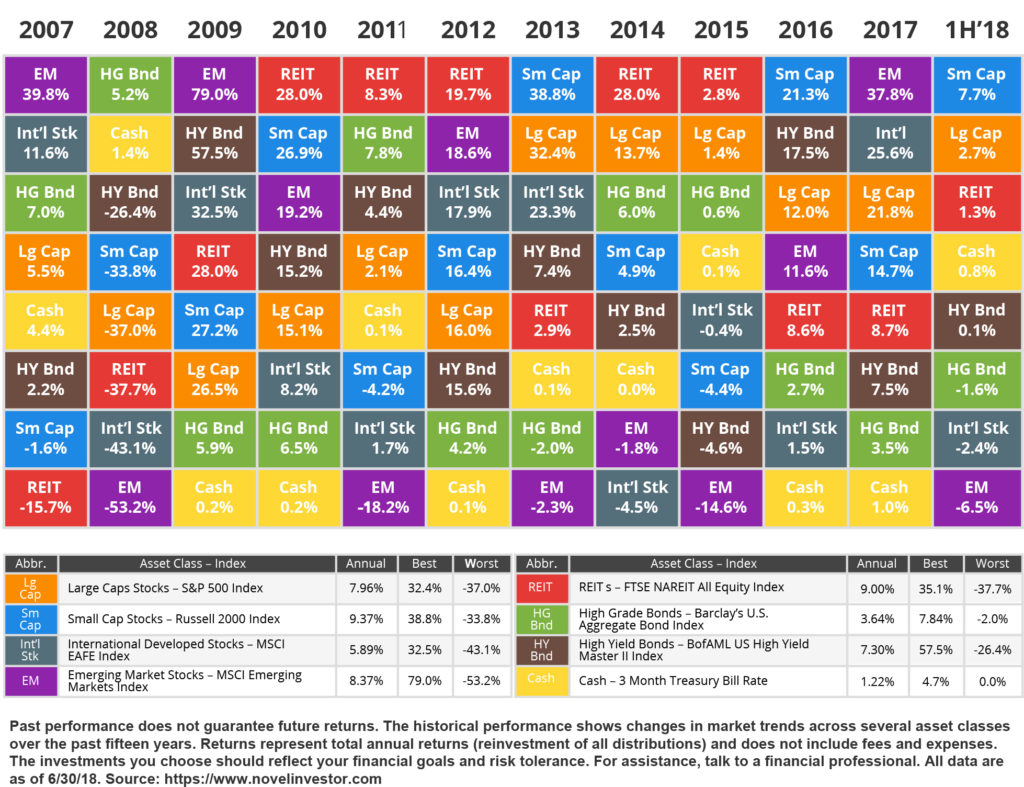

The ten-year chart below illustrates the extent to which different asset classes tend to perform well at different times. Let’s take a look at the government bonds for instance. They underperformed when equity markets were rising but did better in periods of crisis. The chart demonstrates that past performances cannot be used as a guide to future returns.

Asset Class Returns

A well-diversified portfolio spread across a range of assets, markets and geographical regions, has the potential to provide you with lower volatility. It helps you to avoid overexposing your portfolio as a whole to undue risk.

Leave a Reply

Want to join the discussion?Feel free to contribute!